Yet if you still owe money on your residence, your lending institution will require you to have it. Even though it's not legitimately called for, property owners insurance is an excellent suggestion due to the fact that it helps protect your residence and also other possessions. Find out more: 10 steps to locate the best residence insurance coverage 3 questions to ask prior to you get home insurance coverage Types of homeowners coverages Homeowners plans incorporate numerous kinds of coverage right into one plan (lowest homeowners insurance).

pays medical costs, lost earnings, as well as various other expenses for people that you're legally liable for harming. It also pays if you are accountable for damaging a person else's property. It likewise pays your court costs if you're sued because of an accident. pays the medical bills of individuals harmed on your home.

What dangers does a home owners policy cover? Your home owners plan shields you versus various Click here! threats, or dangers. This table reveals typical risks that most plans do and don't cover.

To be fully protected, see to it your plan has substitute price protection. pays to fix or replace your house and personal effects at present costs. For instance, say you acquired a new roofing one decade earlier as well as the current price for a brand-new roofing system is $10,000. If you have to replace your whole roofing system after a tornado, a substitute cost plan would certainly spend for a new roofing at today's rates.

The Ultimate Guide To How Much Does Homeowners Insurance Cost In 2022?

After your $2,000 insurance deductible, your business would certainly pay $5,000. You would certainly have to pay the rest of the cost of the brand-new roofing system on your own.

The Texas Cyclone Insurance Coverage Organization (TWIA) sells wind and hail insurance coverage for coastal residents. Depending on where you live, you could require flooding insurance before TWIA will certainly market you a policy. landlord.

You may not require tenants insurance coverage if you're still a dependent. Your parents' home owners plan could cover your home, also if you're not living at home.

The distinction relies on whether the house owners association has a master policy that covers the outside. If it does, you can get a policy that covers only the interior. If the association's master policy does not cover the exterior, you can acquire a plan that covers both the interior as well as outside.

The Buzz on Cost Of Homeowner's Insurance - Official Website

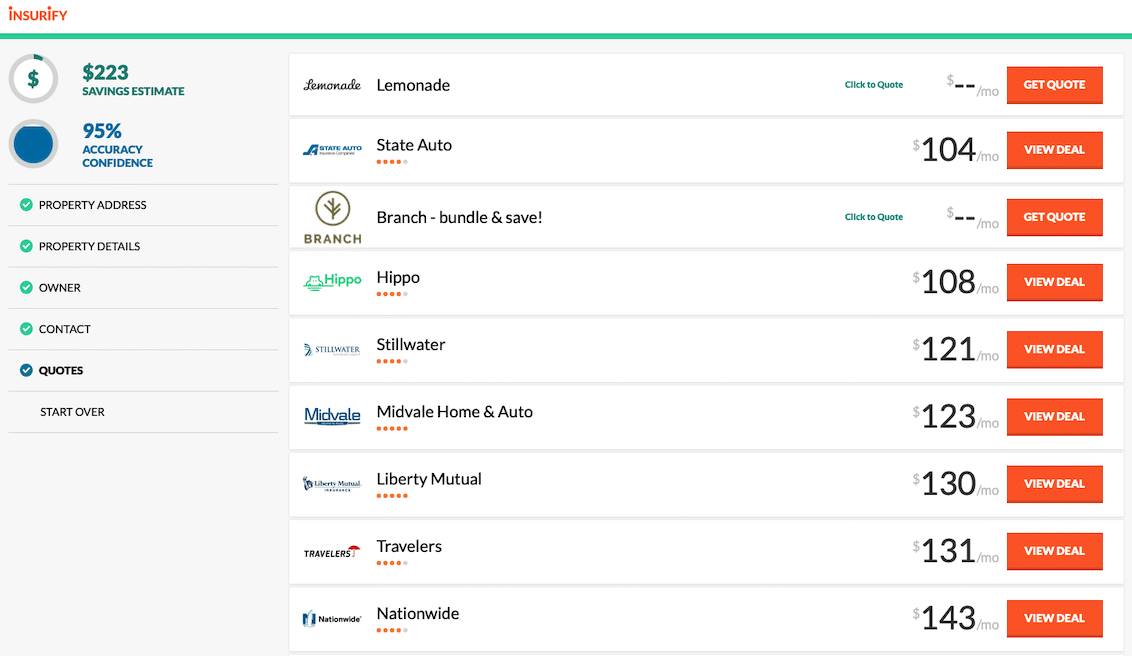

Insurer might appeal our choices. How do firms decide what to charge me? Insurance provider make use of a process called underwriting to decide whether to offer you a plan and just how much to bill you. The quantity you pay for insurance policy is called a premium. Each business's underwriting rules are various.

It additionally suggests that various firms charge different rates. A lot of business take into consideration these points when choosing your costs: Companies can't turn you down just because of your residence's age or worth, but they can charge you more. Residences with greater replacement expenses have greater premiums. Premiums are greater for homes built entirely of timber.

Premiums are reduced for houses that are close to fire terminals. Some companies use your credit score to decide what to charge you.

transform you down, bill you more, or treat you differently than other individuals in your rate or danger class unless the firm can reveal that you're a higher danger than others. turn you down or bill you more just because of your credit report (homeowners). Conserving money on your insurance policy Ask your representative concerning price cuts.

A Biased View of How Much Homeowners Insurance Should You Actually Buy?

Each firm decides what discounts to provide and the quantity of the discount. condo insurance. You may be able to obtain a price cut if you have: an alarm system. a smoke alarm or lawn sprinkler. an impact-resistant roof covering. a newer residence or a residence in good problem. various other plans with the very same insurance business.

Shield your residence and residential property from crime. The firm you selected with the ideal policy and cost may not desire to offer you insurance policy if your house is in poor shape. To help secure your house against burglars: Set up dead bolts on doors and also windows.

A person from the insurance coverage business will certainly examine the exterior of your residence when you apply for insurance policy. Companies may bill you extra or decline to insure you based on what they see.

deductibles a home and home insurance lowest homeowners insurance homeowner insurance

deductibles a home and home insurance lowest homeowners insurance homeowner insurance

As an example, state your costs is $100 a month, or $1,200 a year. If you spent for the full year beforehand, but after that cancel your plan after one month, the company would owe you $1,100 in unearned costs (and home insurance). indicates a company rejects to renew your policy when it ends.

The Definitive Guide to How Much Does Homeowners Insurance Cost? - Allstate

cheapest homeowners insurance security systems affordable insurance low cost homeowners insurance homeowner's insurance

cheapest homeowners insurance security systems affordable insurance low cost homeowners insurance homeowner's insurance

Your home is uninhabited for 60 days or more. A lot of business stop your protection if your home is uninhabited for that lengthy. They usually don't quit your obligation protection. a home. If you plan to be out of your house for an extended time, talk to your business to make certain your coverage continues.

If you can not discover a company to offer you a plan, you might be able to obtain protection via the Texas FAIR Plan Association or an excess lines insurance policy business. Reasonable Strategy as well as surplus lines insurance coverage is extra pricey than protection from a standard insurance policy firm.

You can obtain FAIR Strategy protection if you can not discover a Texas-licensed business to insure you and also at the very least two firms have actually transformed you down (low cost homeowners insurance). To learn more, call your agent or the FAIR Strategy at 800-979-6440. are out-of-state firms that insure dangers that business in Texas won't guarantee. Although they do not have a Texas license, they need to meet state requirements to sell insurance coverage below.

The insurer will base its repayment on the insurance adjuster's price quote. After the firm designates an insurance adjuster to your case, the adjuster will most likely be your major contact with the company. If the damage transforms out to be worse than the insurance adjuster initially believed, you or your service provider can talk with the adjuster concerning elevating the price quote.

The Facts About How Much Does It Cost To Insure A Multimillion-dollar Home? Uncovered

The target date may be much longer after major catastrophes. If the insurer doesn't satisfy the settlement target date, you can file a claim against the business for the amount of the claim, plus interest as well as lawyer charges. insurance discount. There are some exemptions to the due dates: A company that requires even more time can take 45 days to make a decision whether to pay your case.

Discover a lot more: Will my premium rise if I submit a claim? What if I need aid discussing my insurance claim? You can work with a public insurance adjuster to help you. Public insurance adjusters work for you, not the insurance policy firm. Public insurers bill fees for their solutions. Prior to you work with one, ensure you recognize what you'll need to pay.

cheaper homeowners insurance security systems homeowner insurance insurance inexpensive

cheaper homeowners insurance security systems homeowner insurance insurance inexpensive

The mortgage business will transfer the check as well as launch cash to you as the work is done. The home mortgage company may ask you for more info prior to it launches money to you - a home insurance. You might require to give the home loan firm a checklist of the job to be done and also cost estimates, info regarding who's doing the work, as well as timelines.

If you reach your policy's ALE dollar restrictions before your home is totally fixed, you'll have to pay the remainder of your added living expenditures out of your own pocket (insurer). Solving troubles If you disagree with the insurance adjuster's price quote or the quantity the firm is supplying to pay you, tell the insurance business why.

The Best Guide To Compare Home Insurance Rates Online (Updated 2022) - The ...

If that doesn't deal with the concern, right here are your options: The appraisal process is for conflicts concerning the quantity of your insurance claim. It isn't for conflicts concerning whether your plan covers a loss. If you make use of evaluation, you and also the insurance policy firm each hire an appraiser. The 2 evaluators then pick a third evaluator as an umpire.

If the estimates are different, the umpire makes the last decision. The umpire's choice is binding on both you as well as the insurance firm - cheapest homeowners insurance. You pay for your appraiser as well as half of the umpire's expenses.

You can give less notice if waiting would certainly create you to miss out on the target date for submitting a suit. If your claim is for much less than $10,000, you can make use of Justice Court. Justice Court is a special court that handles small-claims disputes (property insurance). You don't require a lawyer, but you have to pay a filing charge and other court expenses ahead of time.

To learn more, call your area justice of the peace office. low cost homeowners insurance. Find out more: Suppose my insurance policy isn't paying sufficient?.

What Does How Much Does Homeowners Insurance Cost? - Aaa Mean?

You got your yearly renewal notice from your house insurer as well as you're stunned: Your premiums have gone up (for home owners insurance). The truth is, it prevails to see a yearly boost in your home owners insurance costs, as well as in a lot of cases, it's not the outcome of something you did. Actually, a lot of it may be completely out of your control.

When you do so, alert your insurance coverage agent, and also it may help decrease your rates. Some Things You Can Do to Assist Avoid a Loss Even in the very best of conditions, a homeowner faces the possibility of a building loss. Fortunately is, there are some activities you can take to help shield versus some of one of the most typical losses.

Related Products & Discounts There are advantages when you pick to bundle your cars and truck, home or other insurance plan. Get a quote today to see just how much you could save when you buy multiple plans with Travelers. This can assist protect your home in case of fire, hail storm, burglary, and other risks - affordable.

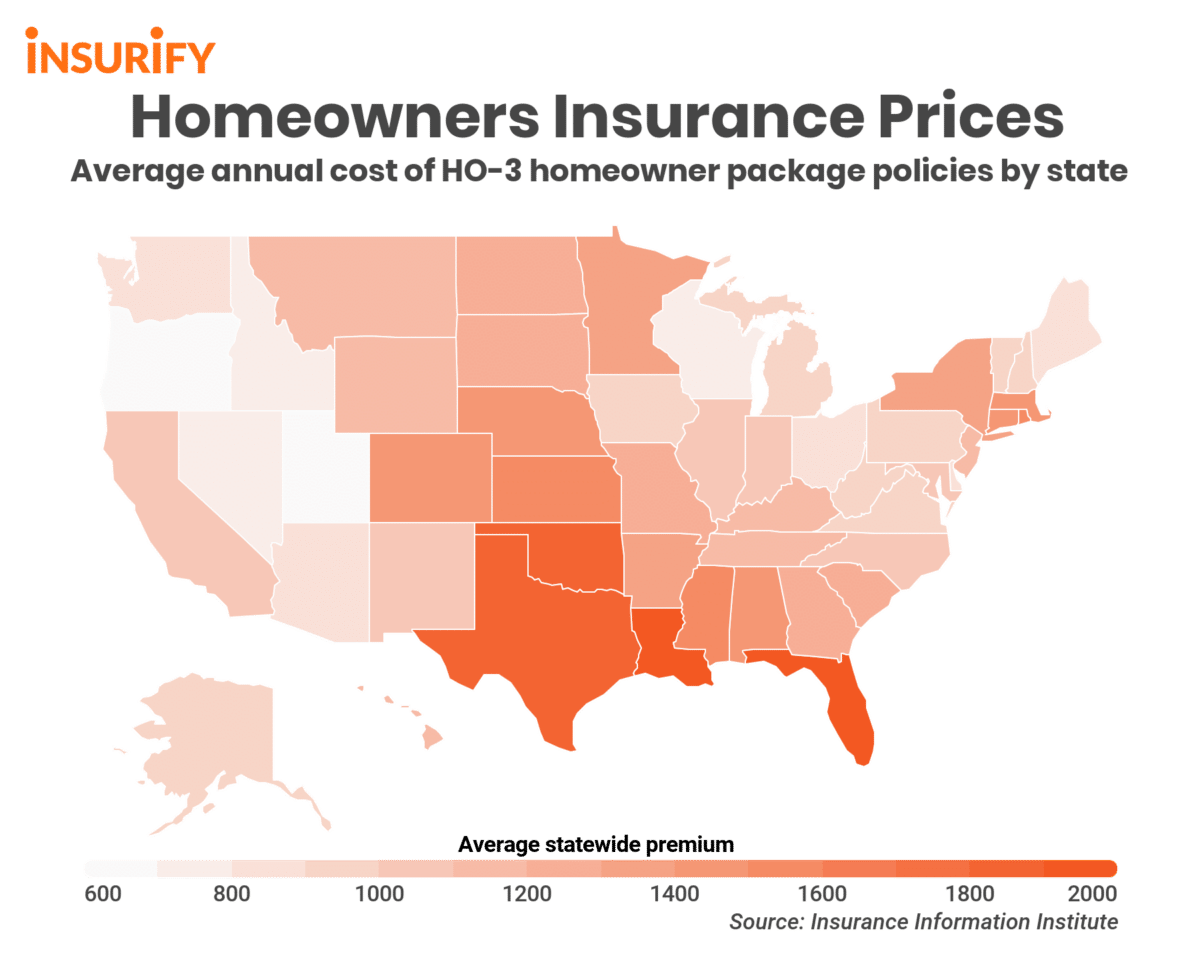

, there's no one-size-fits-all rates. To establish prices, insurance policy business will certainly typically look at your: The even more your home expenses to change after a protected loss, the greater your homeowners insurance coverage price will certainly be.

How Much Does Homeowners Insurance Cost? - Progressive Can Be Fun For Anyone

If your house is older, it may enhance the rate of your property owners insurance plan - deductible. Typically, the older the house is, the harder and expensive it can be to restore it if it were shed in a protected case. If your house is alongside a body of water, it could increase your homeowner's insurance price as a result of the higher threat of flooding.

When choosing a prepare for your building, it is very important to keep in mind that not all homeowners insurance plan are the very same. At The Hartford, our home insurance policy program is endorsed by AARP as well as we pride ourselves on helping property owners identify the coverage they require to make certain their residences are shielded.